Today’s guest, Tewodros Zewdie, is the Executive Director of the Ethiopian Horticulture Exporters and Producers Association (EHPEA). He is also the Program Manager for the Ethio-Dutch Program for Horticultural Development (EDPHD), a program that comprises four major components: Investment Promotion and Improving the Business Climate, Integrated Pest Management (IPM), Capacity Building, and Support for Emerging Entrepreneurs in the Ethiopian Horticulture sector.

With over 17 years of solid experience in agriculture, perishable logistics, policy advocacy, private sector development, journalism, communications, supply chain management, research, and development programs, Tewodros brings a wealth of knowledge to his current roles. Prior to joining EHPEA, he served as the General Manager of the Ethiopian Horticulture Cooperative (EHC), focusing on supply chain activities for the Ethiopian horticulture export industry, particularly in perishable air freight operations.

Tewodros has also held positions as the Media and Communications Manager at the Addis Ababa Chamber of Commerce and Sectoral Association, Marketing and Communications Specialist for the Ethiopian Private Sector Development Hub, Deputy Director of the Addis Ababa Millennium Secretariat, and Communications Affairs Core Process Owner at the Addis Ababa City Government Communication Affairs Bureau. Additionally, he served as the National Conflict Thematic Manager at ACORD, an international NGO, and has written numerous articles for local and international electronic and print media outlets.

He holds a Master’s degree in International Relations and a Bachelor’s degree in Political Science and International Relations from Addis Ababa University, as well as a Bachelor of Science degree in Logistics and Supply Chain Management from the German Foreign Trade and Logistics Academy.

In his interview with The Ethiopia Herald, Tewodros discussed various issues related to business opportunities in Ethiopia’s horticulture sector and EHPEA’s efforts to enhance relations between government institutions and horticulture producers. Enjoy the read!

What makes Ethiopia the best destination for investors in the horticultural industry?

Ethiopia stands out as a unique country for the production and export of horticultural crops, boasting both competitive and comparative advantages. When considering the cost of doing business, Ethiopia is among the most affordable countries.

One key advantage is the abundant sunshine year-round, essential for horticultural crops. With over 60 million people in the country having an agricultural background, there is a plentiful labor force available. Additionally, Ethiopia offers some of the lowest clean energy costs globally, particularly in terms of electricity. The country is also very rich both in surface and ground water that is why it is dubbed as ‘The Water Tower of East Africa’.

The country’s strategic market proximity to the Middle East and Europe is advantageous in comparison with other production areas, as is the presence of Ethiopian Airlines, serving over 130 destinations. Land availability is abundant, with the government offering generous investment incentives to those in the sub-sector. These factors make Ethiopia highly competitive and comparative for horticultural production and export.

Ethiopia’s diverse agro-ecology, with more than 18 zones, allows growing of a wide variety of horticultural crops. This diversity puts Ethiopia on a highly position globally. It is also ideal for investors looking to embark up on the horticulture sector.

The railway connection to Djibouti provides additional logistical capacity for potential investors. Compared to neighboring countries like Kenya, Ethiopia is a leading player in the horticultural export industry, ranking second in export volume and value in Africa.

Compared to neighboring countries like Kenya, what level are we at?

Currently, Ethiopia is the second largest exporter of cut flowers in Africa after Kenya. Ethiopia’s horticulture industry has experienced exponential growth, despite being established for only 15 to 20 years. There is still much potential to be unlocked in the fruit and vegetable segment in Ethiopia, which is fantastic.

One of the advantages of the horticulture sector is its ability to create jobs for skilled and non-skilled fellow compatriots especially youth. Women are the prime beneficiaries of the employment opportunities. They account for more than 75% of the workforce of the industry.

How many people are currently finding employment?

According to data from the Ministry of Agriculture, nearly 200,000 individuals are benefiting from job opportunities in the horticulture sector, as it is labor-intensive. For example, the seed business can generate between 65 to 70 jobs per hectare, while the cutting industry can create 35 to 45 jobs per hectare.

This trend extends to fruit and vegetable companies, which also provide a significant number of job opportunities, particularly for women. In fact, over 75% of the employment opportunities in the sector are for women.

Moreover, the industry is not only creating jobs for unskilled workers, but also for skilled individuals. Graduates from TVET centers and universities can also take advantage of the job opportunities in the sector. Overall, it is clear that the majority of beneficiaries from the sector are women.

How do you monitor whether the industry applies all the legal and technical measures for the work place safety and health of workers?

Every company is expected to comply with standards regarding occupational safety and health (OSH). I believe there has been significant progress in meeting these standards for OSH. We do have an accredited TVET center that elevates the capacity of our members regarding OSH. Continuous training and audit is also undertaken by public and market label standards. Supply chain actors are also putting additional layer of parameters regarding OSH. All is implemented by the farms. But, it doesn’t mean that everything is a bed of roses. There are still some grey areas which should be improved.

How much is the membership of your association? What do you do to address the problems faced by your members?

Currently, we have about 126 members engaged in the production and export of cut flowers, cuttings, fruit, vegetables, vegetable seeds, and herbs.

As a business membership organization, our core function is to defend the interests of our members. We work to promote policies that create a favorable environment for horticulture investors in Ethiopia. Over the past two decades, the association managed to influence a number of policies, regulations, directives, circulars, and guidelines to improve conditions for investors and the country.

Our goal is not only to defend our members’ interests but also to propose policies that benefit the country. Our association has played a crucial role in creating a more favorable environment for the horticulture sector in Ethiopia. Our members, including smallholder farmers, benefit from the policies, regulations, directives and guidelines that are now in place.

Some people are now complaining that the horticulture sector is using chemicals that damage the land. How do you view this issue?

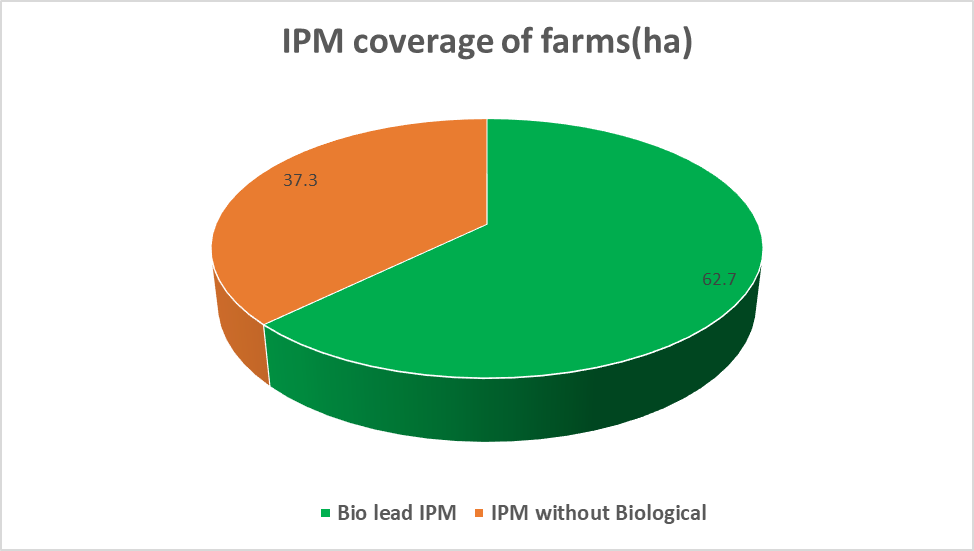

The sector does use chemicals, which is a fact, but all chemicals used are regulated internationally, by standards, and by national regulatory bodies. Additionally, there is a shift towards using biological agents to reduce the application of traditional pesticide.

Chemicals and fertilizers are targeted at crops, not the soil, with efforts to use biodegradable options. The association provides strong training to ensure member compliance. There is a noticeable shift in the Rift Valley towards biological control agents and integrated pest management.

Standards regulate pesticide application, with farms expected to comply. While isolated incidents may occur, most companies are following social and environmental standards. Ethiopia has the potential to earn more foreign currency in the sector, with vast untapped potential in water resources and uncultivated land suitable for horticulture.

As the world population grows, so does the demand for fruit and vegetables. Ethiopia’s ideal conditions make it a prime location for horticulture investment.

How many types of horticultural products are currently being exported from Ethiopia? Why are we unable to expand our export destinations?

Currently, Ethiopian horticultural products are being exported to various regions of the world including neighboring countries, the Middle East, Europe, the Northern Hemisphere, the Far East (such as South Korea and Japan), and even Australia. Despite these export destinations, there is still much untapped potential for economic benefits in the country.

As previously mentioned, the horticulture sector has the potential to generate billions, but this requires a strategic approach. Currently, we are in the validation program stage. It is crucial to establish proactively structured frameworks to support the horticulture industry and ensure seamless integration of all stakeholders and one stop shop support service provision, including collaboration between academic and research institutions and the private sector.

Reviewing the input system in the country is essential, as we currently rely on importing inputs from other countries. Finding breakthroughs in this area is necessary. Access to finance is also a critical issue that needs to be addressed.

Establishing horticultural or horti-parks based on research and study can significantly benefit both the government and the private sector by reducing costs. Investing in skilled manpower for the industry is also essential.

Branding the Ethiopian horticulture industry and complying with international standards are key steps to overcome the challenges we face.

What are the challenges especially faced by horticulture growers? What is your association doing to address these challenges?

Capacity is a major issue. Our association has a TVET center that is working to enhance the capacity of our members so they can meet international standards. We are providing training to thousands of workers and other stakeholders in the horticulture industry to increase capacity.

In terms of input challenges, we are organizing B2B sessions with input suppliers and growers. Infrastructure challenges also exist in some locations. We are closely collaborating with government institutions to address infrastructure issues, such as access roads and electricity connectivity.

Some locations experience frequent power outages, which must be addressed due to the perishable nature of horticultural crops. We are working with the government and service providers to improve agro logistics and maintain the cool chain.

We are also collaborating with international partners on various issues. Emerging challenges like False Codling Moth (FCM) which is a quarantine and priority pest of European Union needs to be addressed. We are working hard to manage it. The association has trained nearly 20,000 industry workers on identifying and managing false codling moth.

We are also building capacity in other areas, such as managing water treatment plants, solid waste disposal, and converting solid waste into compost and other products. These initiatives promote sustainability in the industry.

Quality is fundamental in order to compete other countries. How is the association doing in this regard?

As I mentioned earlier, we are building the capacity of our members on quality issues. We deliver trainings specifically tailored for quality compliance and work with other institutions. We need to partner with a number of institutions to have a better impact at the national level. We have also advocated the incorporation of quality in strategies, and the Ministry of Agriculture has taken steps in that direction.

Quality also requires laboratories and infrastructure, and we are making progress in that area by working with international partners to build regulatory bodies, support the private sector, and assist growers.

Horticulture growers are not adding any value to their products; they are simply exporting raw materials. What is the challenge in doing so?

There are debates about exporting versus importing. In my opinion, there is no conflict if you are focused on exporting. Working in export can help build knowledge and experience, which is the trajectory of the industry in the Rift Valley.

There has been a growth in commercial farms supplying the local market, which could be seen as an extension of companies working on export commodities. I do not see any conflict between working for export and working for local produce. The government has invested billions in constructing Integrated Agro-Industrial Parks. Processors in the parks need also consistent supply of inputs as well.

I believe more companies should enter the scene to supply processors located in integrated agro-industrial products. We have not fully utilized the country’s potential for export or local consumption. I think there is enough potential for both export and local consumption in Ethiopia. The country can benefit greatly from exporting while also supplying the local population and local processing needs. Volume is crucial. We need to focus on producing in a sustainable manner, which requires proper strategies, coordination, collaboration, and synergy.

What does the horticulture strategy mean for your association?

We have been urging the government to create a strategy in collaboration with relevant stakeholders. The development of the strategy began three years ago. There was a previous strategy focused on smallholder farmers.

The current strategy is being reviewed to align with current economic reforms and international trends. Proper implementation of this strategy could make a significant difference. It aims to address bottlenecks and make Ethiopia competitive in the global horticulture industry supply chain.

These are the questions I have for you today. If you have any additional points to add, please feel free to do so.

I believe that the future of Ethiopia lies in horticulture. We can generate significant and respectable employment opportunities within this sector. This will necessitate collaboration between the government, private sector, and development partners. By doing so, we can effectively combat unemployment and underemployment in Ethiopia.

By supplying processing companies, we can potentially generate billions for Ethiopia. To achieve this, we must establish proactive frameworks to bolster the industry.

Thank you for your time and willingness.

BY GIRMACHEW GASHAW

THE ETHIOPIAN HERALD SATURDAY 20 JULY 202

https://press.et/herald/?p=99195